Sahamati, the industry alliance spearheading the Account Aggregator (AA) ecosystem, is celebrating one of India’s fastest-growing Digital Public Infrastructures (DPIs) – a cross-sectoral framework ushering in an era of open finance. While the Reserve Bank of India issued the AA Master Directions on September 2, 2016, the framework was officially launched on September 2, 2021, under the leadership of Shri Rajeshwar Rao, Deputy Governor. To honor this milestone, September 2 is now observed as AA Foundation Day, commemorating the beginning of India’s consent-based data empowerment journey.

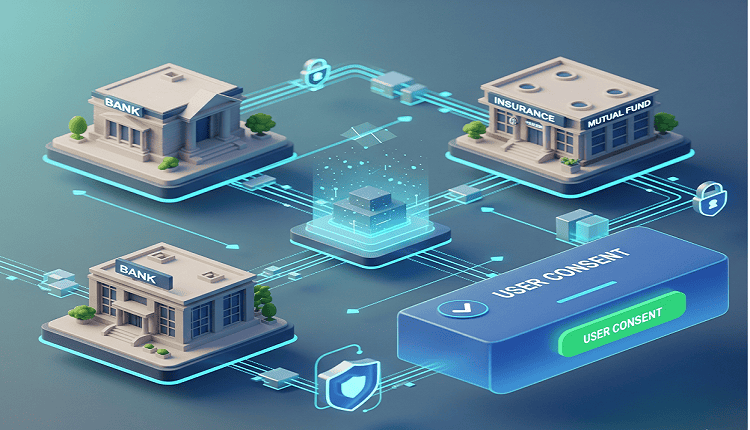

In just four years, the AA framework has grown from vision to global benchmark, transforming financial services delivery across sectors with consent-based data sharing. It has become a key building block of India’s DPI stack, standing alongside Aadhaar and UPI. Just as UPI revolutionized payments, AA is reshaping secure data access—citizen-first, scalable, and built on trust.

AA’s Scale in Four Years:

- 780+ financial institutions live, spanning banks, NBFCs, insurers, mutual funds, pension funds, stockbrokers, and wealth managers.

- 2.12+ billion accounts enabled for consent-driven data sharing.

- 16 licensed Account Aggregators operational.

- 269+ million customer consents executed.

- ₹1.6 lakh crore in estimated loan disbursement powered by AA in 2025 alone.

- 4–5 crore customers have already accessed financial services (loans, insurance, PFM, portfolio management) via AA.

- Loan approvals for MSMEs cut from weeks to under 48 hours.

- Significant expansion of lending to new-to-credit customers.

For individuals, AA unlocks instant credit, tailored protection, and relevant financial advice. For MSMEs, transaction data now acts as collateral, enabling affordable working capital. For financial institutions, API-standardized flows drive better underwriting, reduce fraud, and lower costs.

BG Mahesh, CEO, Sahamati, said:

“Four years ago, the Account Aggregator framework was just taking its first steps. Today, it is emerging as a cornerstone of India’s digital public infrastructure, enabling millions to access credit and financial services with consent, trust, and transparency. This anniversary is both a celebration and a reminder of the vast opportunities ahead.”

Looking forward, Sahamati and ecosystem participants are focused on expanding AA use cases beyond credit, driving deeper adoption across industries, and cementing India’s global leadership in open finance. The journey of AA so far is only the beginning—the framework’s potential to redefine secure data sharing for citizens and businesses will continue shaping the future of India’s digital economy and beyond.